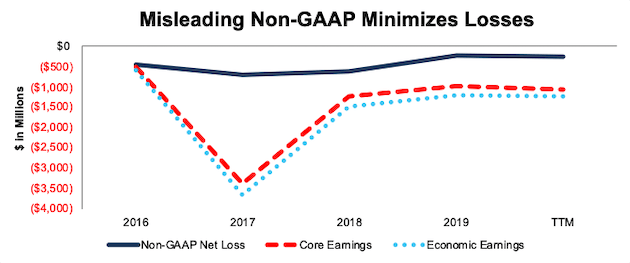

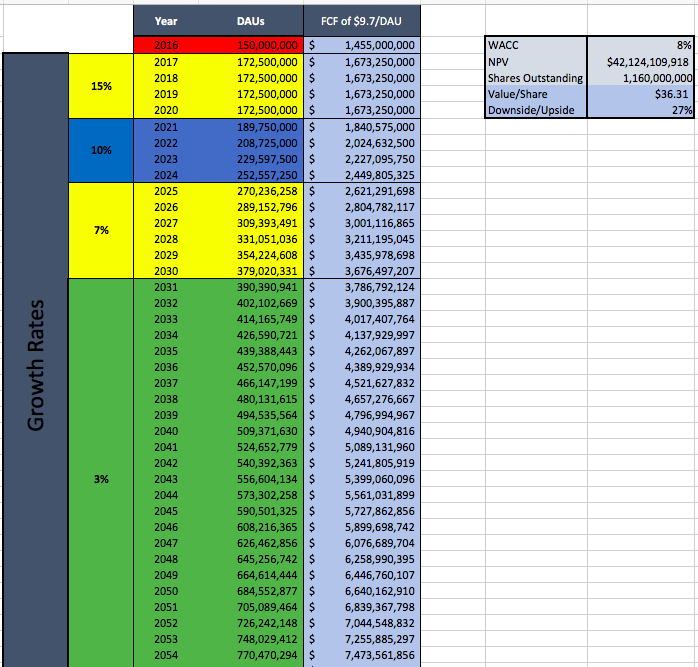

Profitability looks solid: adjusted EPS of $0.17 was more than double analyst estimates, while Adjusted EBITDA of $175 million crushed the company's projection of $100 million to $120 million. Snap's revenue of $1.067 billion missed Wall Street consensus and the low end of its post-Q2 guidance by $30 million, or less than 1%. Snap's third quarter report was disappointing, although the quarter itself wasn't that bad. But given the valuation even after the decline, and very real challenges facing Snap, that doesn't look like enough to step in and buy this dip. Optimists would argue that's still true after the report - and they're probably correct. This now looks like an innovative company with the heft to be a social media leader for decades to come. Those gains alone, along with a return to user growth and vastly improved monetization, have quieted the concerns around leadership. Even with a 27% decline on Friday following Thursday's after-hours third quarter earnings report, SNAP shares have rallied 1,200% from December 2018 lows. Less than three years later, Snap Inc., Spiegel, and SNAP stock all look very different. Even at that point, shares didn't look particularly cheap relative to revenue, while the company continued to post enormous losses, even on an adjusted basis.

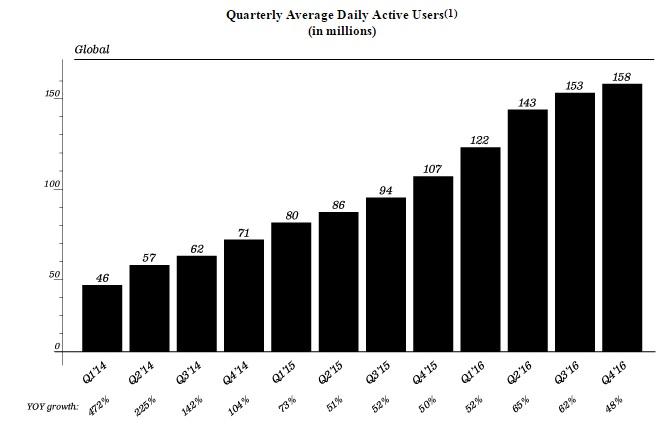

With monetization weak, users flatlining, and questions surrounding management, SNAP stock fell below $5 in late 2018. where quarterly ARPU (average revenue per user) stayed below $1. Snap couldn't find a way to drive much revenue, particularly outside the U.S. The Wall Street Journal reported that founder and chief executive officer Evan Spiegel had rushed that redesign due largely to his experiences on a trip to China.

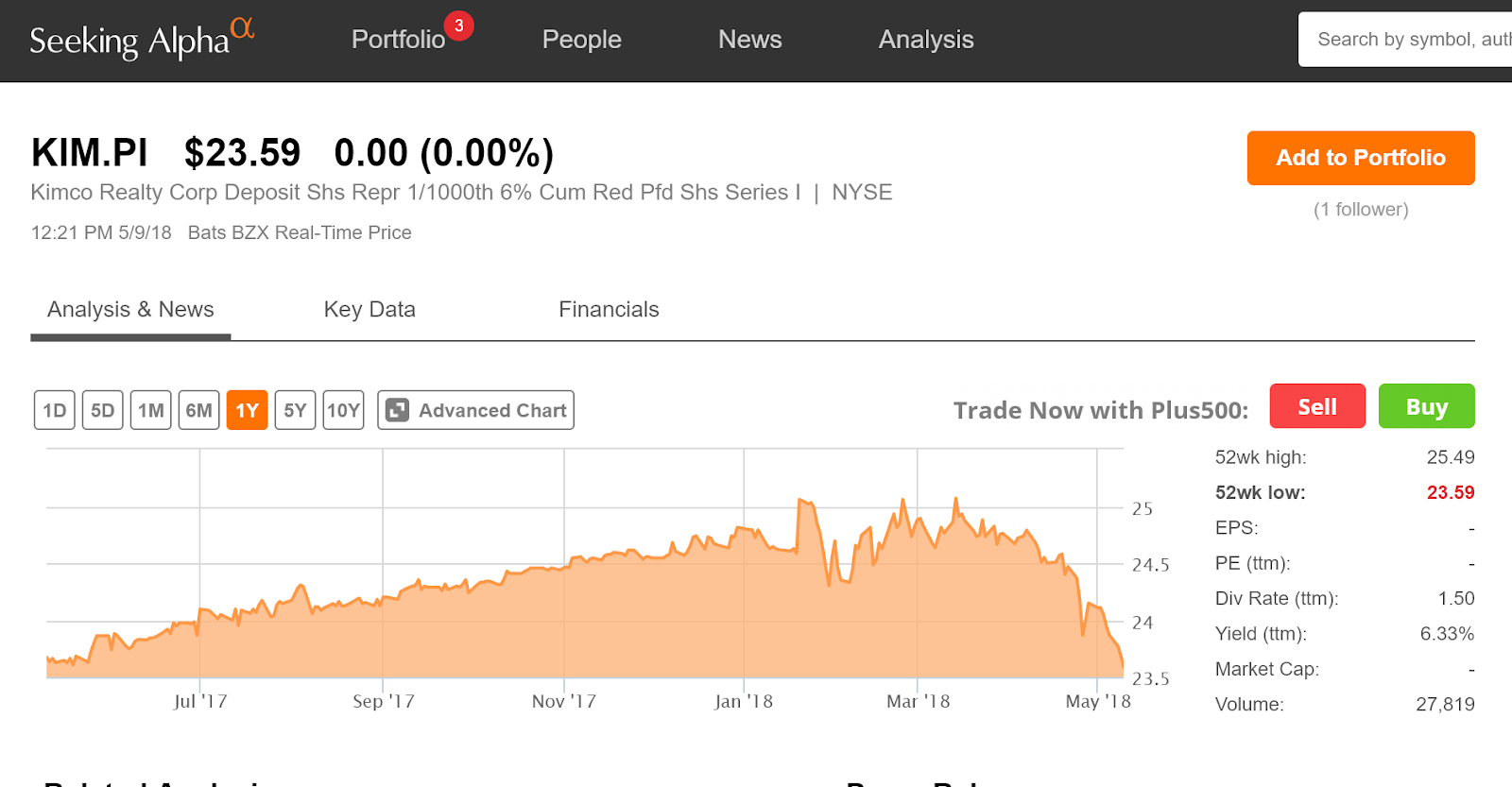

Seeking alpha snap stock price android#

A redesign of the Android app proved to be a public relations disaster, and led to the company's first-ever decline in users. User growth stalled out almost immediately. SNAP stock rallied 44% on its first day of trading after its March 2017 initial public offering, but from that point on the company quickly became a so-called "busted IPO". It's easy to forget, but it wasn't all that long ago that investors did not trust Snap ( NYSE: SNAP) at all. Fastenal Company was founded in 1967 and is headquartered in Winona, Minnesota.Wachiwit/iStock Editorial via Getty Images It also serves farmers, truckers, railroads, mining companies, schools, and retail trades and oil exploration, production, and refinement companies, as well as federal, state, and local governmental entities. The company serves the manufacturing market comprising original equipment manufacturers maintenance, repair, and operations customers and non-residential construction market, which includes general, electrical, plumbing, sheet metal, and road contractors. It also offers miscellaneous supplies and hardware, including pins, machinery keys, concrete anchors, metal framing systems, wire ropes, strut products, rivets, and related accessories. The company’s fastener products include threaded fasteners, bolts, nuts, screws, studs, and related washers, which are used in manufactured products and construction projects, as well as in the maintenance and repair of machines.

It offers fasteners, and related industrial and construction supplies under the Fastenal name. Fastenal Company, together with its subsidiaries, engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

0 kommentar(er)

0 kommentar(er)